Maxlend: The Ultimate Guide To Streamline Your Financial Needs

Are you tired of jumping through hoops just to get a loan? Maxlend is here to change the game and make borrowing easier than ever. Imagine getting approved in minutes without all the hassle of traditional banks. Sound too good to be true? Well, buckle up because we’re diving deep into everything you need to know about Maxlend. It’s not just about loans—it’s about empowerment.

Let’s face it, life throws curveballs at us all the time. Whether it’s an unexpected car repair or a medical bill, having access to quick cash can save the day. That’s where Maxlend steps in. This online lender has been making waves in the financial world, offering fast, convenient solutions for people who need a little extra help.

In this article, we’ll break down everything you need to know about Maxlend—how it works, its pros and cons, and whether it’s the right choice for you. We’ll also sprinkle in some expert advice so you can make an informed decision. Ready to explore? Let’s get started!

- Hdhub4u 2025 Your Ultimate Guide To Bollywood Streaming

- Masa 49 A Journey Through Time And Innovation

What is Maxlend? Understanding the Basics

First things first, what exactly is Maxlend? Simply put, Maxlend is an online lending platform designed to simplify the borrowing process. Unlike traditional banks that often require piles of paperwork and weeks of waiting, Maxlend offers a streamlined approach. You apply online, get approved quickly, and receive your funds fast. It’s like having a financial superhero in your corner.

How Maxlend Works

Here’s the lowdown on how Maxlend operates. The process is super straightforward:

- Apply online in just a few minutes.

- Get instant approval based on your creditworthiness.

- Receive your funds directly into your bank account.

- Repay the loan according to your agreed terms.

It’s that simple. No hidden fees, no surprises. Maxlend prides itself on transparency, ensuring you know exactly what you’re signing up for.

- Aditi Mistry Nip Slip What You Need To Know And Why It Matters

- Movierulzcom 2025 The Ultimate Streaming Hub Youve Been Waiting For

Who Can Use Maxlend?

Maxlend is open to anyone who meets their basic eligibility criteria. Typically, this includes:

- Being at least 18 years old.

- Having a valid Social Security Number (SSN).

- Providing proof of income.

- Having an active bank account.

While having good credit isn’t always necessary, it does help improve your chances of approval and better terms. But don’t worry if your credit isn’t perfect—Maxlend works with people from all credit backgrounds.

Why Choose Maxlend Over Traditional Banks?

So, why should you consider Maxlend over heading to your local bank branch? There are several reasons:

Speed and Convenience

Time is money, right? With Maxlend, you don’t have to waste hours filling out forms or waiting for approvals. Everything happens online, and many applicants receive their funds within a day. Can your local bank say that? Probably not.

Flexible Loan Options

Whether you need $500 or $5,000, Maxlend offers flexible loan amounts tailored to your needs. Plus, repayment terms are designed to fit your budget, giving you more control over your finances.

Customer Support

Maxlend understands that borrowing can sometimes feel overwhelming. That’s why they offer 24/7 customer support to answer any questions you might have. From application issues to repayment queries, their team is always ready to assist.

Maxlend Loan Process: Step-by-Step Guide

Now that you know the basics, let’s walk through the Maxlend loan process step by step:

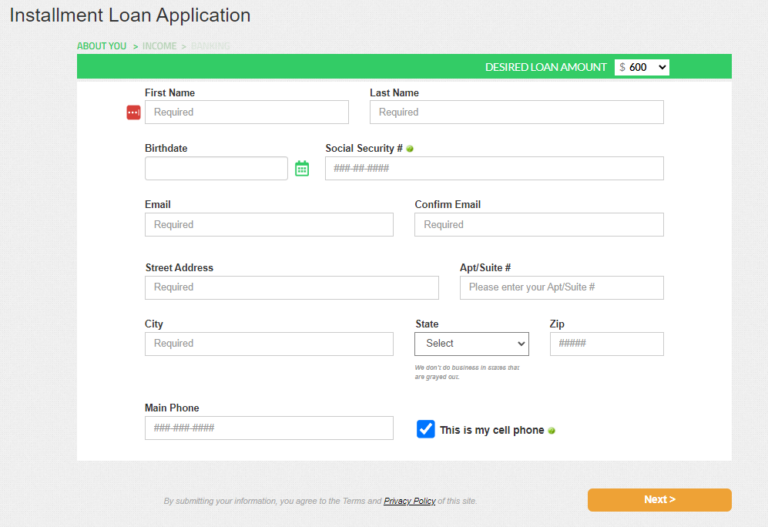

Step 1: Apply Online

Head over to the Maxlend website and fill out the application form. You’ll need to provide some basic information, such as your name, address, income, and employment details. Don’t worry—your data is kept secure and confidential.

Step 2: Get Approved

Once you submit your application, Maxlend will review your information and determine your eligibility. If approved, you’ll receive an offer detailing the loan amount, interest rate, and repayment terms.

Step 3: Receive Your Funds

After accepting the offer, Maxlend will deposit the funds directly into your bank account. In most cases, this happens within 24 hours, sometimes even faster.

Step 4: Repay Your Loan

Repayment is easy and hassle-free. You can set up automatic payments or pay manually via your bank account. Sticking to your repayment schedule helps build trust and may even improve your credit score over time.

Maxlend Fees and Interest Rates

Before diving into a loan, it’s important to understand the costs involved. Maxlend’s fees and interest rates vary depending on factors like loan amount, repayment term, and your credit profile. Here’s a breakdown:

- Origination Fee: A one-time fee charged when you take out the loan.

- Interest Rate: Ranges from 5% to 36%, depending on your creditworthiness.

- Late Payment Fee: Applied if you miss a payment deadline.

While these fees might seem steep, they’re standard in the lending industry. Always read the fine print to ensure you understand all the costs upfront.

Pros and Cons of Using Maxlend

Like any financial product, Maxlend has its advantages and disadvantages. Let’s weigh them out:

Pros

- Quick and easy application process.

- Flexible loan amounts and repayment terms.

- 24/7 customer support for assistance.

- Accessible for people with less-than-perfect credit.

Cons

- Higher interest rates compared to traditional banks.

- Strict repayment schedules that may not suit everyone.

- Potential for debt if not managed responsibly.

Ultimately, the decision to use Maxlend depends on your financial situation and needs. If speed and convenience are top priorities, it could be a great option for you.

Maxlend Reviews: What Do Customers Say?

Curious about what real Maxlend users think? Reviews can provide valuable insights into the platform’s strengths and weaknesses. Here’s a snapshot:

Positive Feedback

- “The application process was so easy, and I got my money super fast!”

- “Maxlend saved me during a tough financial period. Highly recommend!”

- “Their customer service is top-notch. Always quick to respond.”

Negative Feedback

- “The interest rates are pretty high, so be prepared for that.”

- “I had trouble changing my repayment date, which was frustrating.”

- “If you miss a payment, the late fees add up quickly.”

While there are mixed opinions, most users appreciate Maxlend’s convenience and reliability. As with any financial service, it’s essential to do your research and make an informed decision.

Maxlend vs. Other Online Lenders

With so many online lenders out there, how does Maxlend stack up against the competition? Here’s a quick comparison:

| Feature | Maxlend | Competitor A | Competitor B |

|---|---|---|---|

| Loan Amount | $500 - $5,000 | $1,000 - $10,000 | $300 - $3,000 |

| Interest Rate | 5% - 36% | 7% - 30% | 10% - 40% |

| Repayment Term | 6 - 36 months | 12 - 60 months | 3 - 24 months |

| Customer Support | 24/7 | 9am - 5pm | 24/7 |

As you can see, Maxlend offers competitive terms and features, making it a solid choice for many borrowers.

Tips for Using Maxlend Responsibly

Borrowing money is a big responsibility, so here are some tips to help you use Maxlend wisely:

- Budget carefully before applying for a loan.

- Only borrow what you truly need.

- Set up automatic payments to avoid late fees.

- Monitor your credit score regularly.

By following these guidelines, you can ensure a positive experience with Maxlend while keeping your finances on track.

Final Thoughts on Maxlend

Maxlend is more than just another online lender—it’s a tool that empowers people to take control of their financial futures. With its quick approval process, flexible loan options, and excellent customer support, Maxlend stands out in a crowded market.

But remember, borrowing should always be done responsibly. Take the time to evaluate your needs, compare options, and choose the solution that works best for you. And if Maxlend seems like the right fit, go ahead and give it a try!

Got questions or thoughts? Drop a comment below or share this article with someone who might find it helpful. Together, let’s make smarter financial decisions!

Table of Contents

- What is Maxlend? Understanding the Basics

- How Maxlend Works

- Who Can Use Maxlend?

- Why Choose Maxlend Over Traditional Banks?

- Maxlend Loan Process: Step-by-Step Guide

- Maxlend Fees and Interest Rates

- Pros and Cons of Using Maxlend

- Maxlend Reviews: What Do Customers Say?

- Maxlend vs. Other Online Lenders

- Tips for Using Maxlend Responsibly

- Fry99com Electronics Friv Games Adult Content What You Need To Know

- Lacy Kim Onlyfans Leak The Full Story And Its Implications

MaxLend installment loans review April 2021

MaxLend installment loans review April 2021

MaxLend